Invoice Template Generator

Fill in your business details in the invoice template below to create a professional invoice for your customers.

How to Use the Free Invoice Template Generator

Use this free invoice generator to create and download professional invoices to send to your customers. Start by filling in your business details in the invoice template below to populate the statement. You can:

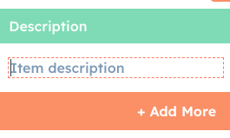

- add additional line items by clicking the “+ Add More” button.

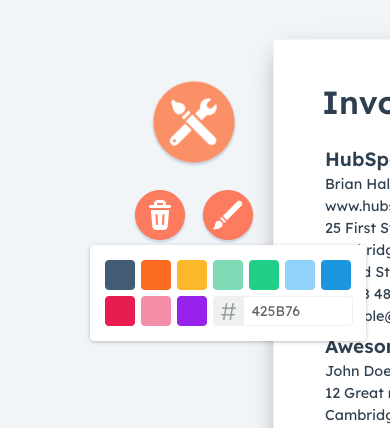

- When you’re done with the details, click on the tools icon to the left to customize your color scheme.

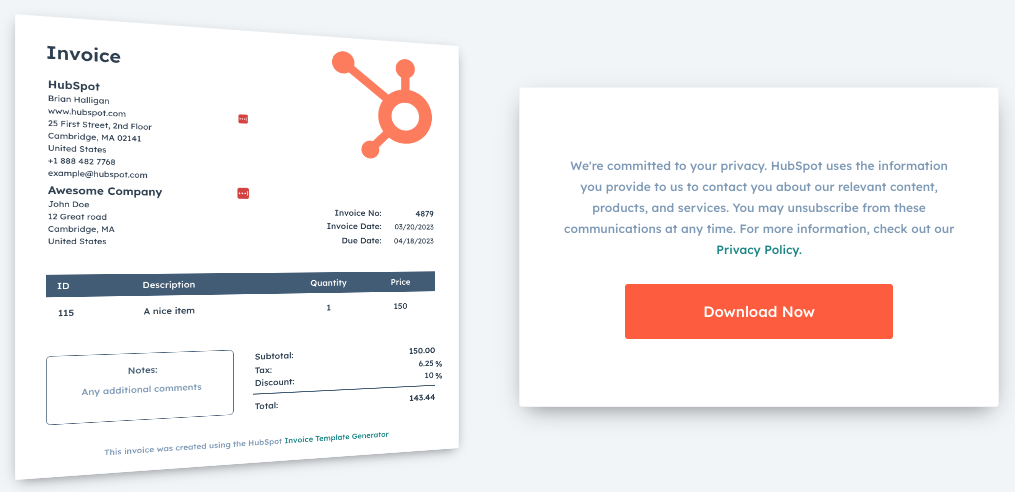

- When complete, click the “Download Now” button to download the invoice PDF.

Once you’ve downloaded the invoice, send it to your customers via email or print it and mail it directly.

Looking for more blank invoice templates to choose from?

We’ve created 10 free invoice templates for Microsoft Word to meet all of your invoicing needs. Simply fill out the form below to access the templates. The templates are fully editable and can be downloaded as a PDF to send off to your customers.

Free Invoice Templates

Tell us a little about yourself below to gain access today:

Say goodbye to the hassle of creating invoices – with our online tool, it's never been easier!

Add your Business Details

Upload your logo

Add items to the invoice

Get your free invoice

Create your business invoice for free

Tired of the time-consuming process of manually creating invoices? Say hello to HubSpot's Invoice Generator! With our free, easy-to-use tool, you can quickly and effortlessly generate professional-looking invoices that showcase your brand and impress your clients. Plus, you can customize your invoices with your own colors to give your business a polished and professional look.

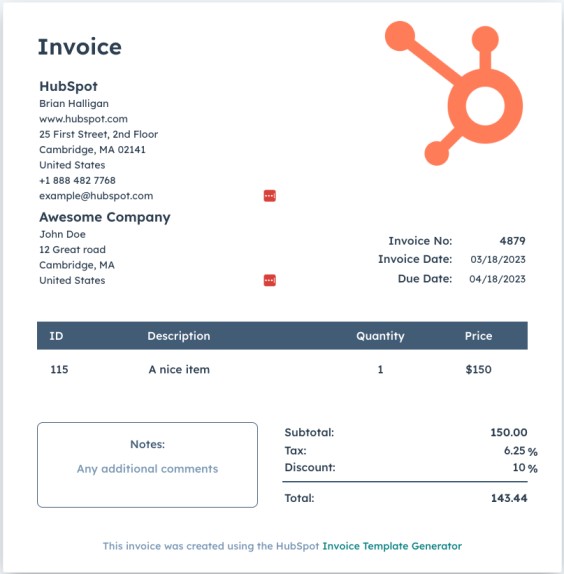

Just check out this free invoice sample! As you can see, our tool allows you to customize every aspect of your invoice, from the logo to the line items and payment details. And with our intuitive interface, you can make invoices in just a few clicks, saving you time and hassle. So whether you're a freelancer, small business owner, or an enterprise, HubSpot's Invoice Generator has everything you need to create and manage invoices with ease. Try it out today and see the difference it can make for you.

Craft a remarkable custom invoice

Use HubSpot's invoice maker to generate a personalized invoice in a straightforward and effortless manner. Take advantage of the pre-designed template, click on the toolkit icon and use your branded color!

Make HubSpot's invoice creator a part of your business by repeating the process as many times as needed. Whether you have to include VAT or update invoice numbers, our tool has you covered. Small and medium-sized enterprises (SMEs) and consultants can use it safely and efficiently, without having to create invoices manually in Word or other software.

Download the free PDF template, then print and send your invoice via mail or email. Our flexible template is designed to meet your needs and streamline your invoicing process.

Invoice FAQs

-

An invoice, or sales invoices, is a billing document issued by a seller to a customer.

The document typically:

- Details the contact and billing information

- Quantifies an itemized list of goods or services sold

- Provides a clear total for the purchase

- Defines any discounts or specific payment terms

- Contains a unique invoice number and date

-

An invoice number is a unique number that you assign to each new invoice you create. These numbers are then used to organize and track each invoice you send.

Your invoice numbers should be assigned in sequential order. For example, your very first invoice might be “invoice no. 1,” followed by “invoice no. 2,” and so on. Invoice numbers aren’t specific to one customer, so you should keep a running total across all of the invoices you send.

That being said, some businesses choose to adapt their numbering system to meet their individual needs. This might mean that you choose to incorporate the date into your invoice number for filing purposes, like this: 20172711-001.

-

- Include the word "Invoice."

- Assign a unique invoice number and date.

- Provide your business name and contact information.

- List out the details of the product(s) or service(s) you provided -- include quantity, rates, hours, etc.

- Provide the name and contact information of the customer.

- Highlight the subtotal.

- Specify any payment details or a due date if necessary.

While your invoice details will change slightly depending on whether you are providing a service or a product (e.g., billable hours and rate vs. quantity and cost), the above guidelines serve as best practices for creating a professional invoice.

-

When it comes to actually sending your invoice off to the customer, you have a couple of options:

- Send the invoice electronically via email or website.

- Send the invoice via postal mail.

When sending an invoice electronically, you may send it through email or directly from your accounting or invoicing software. For many businesses, this is a preferred sending method, as it allows you to deliver invoices to a customer in real time. Invoices that are sent electronically are often paid electronically -- or, less commonly, paid via mail.

When sending an invoice by postal mail, make sure that you consider the time it will take for your invoice to arrive. While this tends to be the slower of the two options, many businesses still send invoices via postal mail to meet the needs and demands of their specific audiences.

-

There are many different layout options for invoices, but the most important thing is to include all of the necessary information in a clear and concise manner. The layout should also be easy to read and understand. Some common elements that should be included in an invoice layout are the following:

- Company name and contact information

- Invoice number

- Date

- List of products or services purchased

- Quantity

- Unit price

- Total amount due

- Payment terms

- Due date

-

When you are invoicing a client, it is important to include all of the relevant information so that they can easily make the payment. Here is how to fill out an invoice:

- Include your name and contact information. This should include your full name, business name (if applicable), address, phone number, and email address.

- Include the client's name and contact information. This should include their full name, business name (if applicable), address, phone number, and email address.

- Include the invoice date. This is the date that you are sending the invoice to the client.

- Include the due date. This is the date that the client needs to make the payment by.

- Include a description of the services rendered. This should be a detailed description of the work that you did for the client.

- Include the cost of the services rendered. This should be a breakdown of all charges associated with the work you did for the client, including any taxes or fees.

- Include any special instructions. This is where you can include any additional information that the client needs to know in order to make the payment, such as if there is a minimum amount required or if there are discounts for early payment.

By following these simple instructions, you can ensure that your invoice includes all of the necessary information and that the client can easily make the payment. If you need to fill out an invoice, HubSpot's Invoice Generator can make the process easy. Simply enter in the necessary information and our free invoice maker will do the rest. You can then download or print the completed invoice for your records.

-

The term “invoice” is often adopted in business environments to define a payment request for goods or services purchased by a specific customer. Once the customer receives the invoice, they will typically refer to it as a bill that they now owe to the seller.

That being said, it’s not uncommon for the two terms to be used interchangeably, as they both refer to an itemized statement of payment owed to a seller by a buyer.

-

- Standard Invoice

- Shipping Invoice

- Service Invoice

- Pro-forma Invoice

- Commercial Invoice

- Recurring Invoice

The standard invoice is the most common invoice type. The standard invoice includes all of the basic information needed to complete an invoice, including contact information for the buyer and seller, an invoice number, an invoice date, itemized purchases, and a clearly defined subtotal.

The shipping invoice serves as a formal payment agreement for goods sold between a seller and a customer. For shipping invoices, information typically includes the cost and number of each item, the subtotal after shipping fees and taxes, the contact information of both parties, as well as an invoice date and number.

The service invoice is often used by service businesses that bill customers based on hourly rates for services such as consultants, graphic designers, website developers, lawyers, auto repair technicians, and so on. On service invoices, the subtotal is a reflection of the billable hours invested.

The pro-forma invoice can be best compared to a quote or estimation. The pro-forma invoice type is often used as a first step in negotiating a payment agreement and is not considered a true invoice, as it does not demand payment.

The commercial invoice is used for customs in instances where goods are being exported across international borders. The commercial invoice contains many of the elements of a standard invoice, in addition to the manufacturing country of the goods, what the items are being used for, the Harmonized System codes (if known), the number of packages and their total weight, and the reason for export.

The recurring invoice typically contains a fixed price and is sent on a monthly basis for rented goods or services such as an apartment, business software, cell phone bills, and so on. Recurring invoices will continue to be sent until the customer's contract or subscription expires.

-

While creating an invoice might not sound like a big branding opportunity, having a well-designed, professional invoice can make a big difference in the eye’s of your customer -- and help you get paid on time.

Before making any type of payment, customers want to ensure that they are doing business with a credible, trustworthy company. This means your invoices should be error-free with consistent branding and a clear, itemized list of goods or services.

If you need help organizing all of the must-have information that comes on an invoice, download the free invoice templates above.

-

If you need to create an invoice but don't have the time or money to invest in specialized software, you can use HubSpot's free online invoicing generator. This tool lets you quickly and easily create professional-looking invoices that can be customized to fit your business' needs. Plus, it's completely free to use!

-

Yes, invoices can be handwritten indeed. Depending on your needs and preferences, there are several ways to write an invoice. If you have a technical background or understand basic accounting principles, writing an invoice yourself may be a viable option. If you would rather not go through the process of creating one yourself or using software, you can always find an accountant who is experienced in writing invoices.

Writing an invoice yourself can be a risky proposition if you do not have the appropriate background in accounting. Even if you are experienced with invoicing, mistakes can occur if the invoice is not properly formatted or contains incorrect information. Additionally, there may be legal issues that arise if the invoice you write does not comply with local regulations. It is important to ensure that any invoice you write is compliant with applicable regulations and laws so as to avoid potential penalties or fines from local authorities.

-

An invoice is a legal document and must include certain key information in order to be considered legal. Generally, invoices should include the customer’s name, address and contact details; an invoice number; a description of the goods and/or services sold; the quantity of each item; the total amount due indicated in both numerical and written form; any applicable tax rates applied to the sale; and the date the invoice was issued. Depending on the jurisdiction, additional information such as terms of payment or a unique customer identifier may also be required for an invoice to be considered legal.

-

In certain circumstances, it is possible to issue an invoice without VAT. This would generally be the case where the goods or services being invoiced are exempt from VAT, such as educational services or food products in some countries. Additionally, businesses which have an annual turnover below a certain threshold (which varies by country) may not be required to charge VAT on their invoices. It is important to check local laws and regulations when issuing an invoice so as to ensure that you are compliant with local tax requirements.

-

Yes, you can create your own invoice template. When creating an invoice, it is important to make sure that key information such as customer information, item and service descriptions, quantity, amount due and payment terms are included. Additionally, the language of the invoice should be clear and concise so as to avoid confusion. Our own free invoice template tool can help you with this.

Depending on local law and regulations, you may need to include additional information for the invoice to be considered legal.

-

When writing a letter to request an invoice, it is important to clearly state the purpose of the letter in the opening sentence. You should then provide further details regarding the invoice requested such as any relevant account numbers, dates and quantities. Once you have provided all of the necessary information for your request, you should sign off with a formal closing line such as “Sincerely” or “Regards” followed by your name and contact information.